40+ Refinance mortgage how much can i borrow

Homeowners can also use the program to refinance their existing mortgage and add the cost of. How much youll pay is indicated by your interest rate.

Family Loan Agreement Template Free Family Loan Resume Template Examples

Home buying with a 70K salary.

. The current average mortgage rate for a 30-year fixed-rate loan is 566 according to Freddie Mac. Type in your mortgage. While 20 percent is thought of as the standard down.

Thats about two-thirds of what you borrowed in interest. It is probably worth considering a mortgage refinance if you can reduce your current interest rate by at least 05. FHA 203k loans help homebuyers purchase a home and renovate it all with a single mortgage.

The less you. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. Starting a budget can be as easy as taking some simple steps.

The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. You also dont have to refinance into a 30. Your home value has increased considerably.

Adjustable-rate Mortgage 15 20 and 30-year Mortgage. Lenders assess different financial factors to gauge your creditworthiness. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

You can refinance your mortgage to take. This money is applied straight to your loan balance. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

Determine a budgeting method. First the borrower should know what the lender believes the borrower can afford and what size of a mortgage the lender is willing to give. If your mortgage rate is above 666 now is probably a good time to refinance.

How to borrow from home equity. In this way each party will agree to a split of the property whether its 5050 6040 or 7030 etc. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

Please specify how much you would like to consider as down payment. The choice of whether to get cash out when you refinance. The cost of borrowing the money.

Available in all 50 states and the District of Columbia. Not licensed in all 50 states. Needs wants and savings.

Formulas are used to get. Please note that it is assumed the down payment is not borrowed. On Saturday September 03 2022 the current average 30-year fixed-mortgage rate is 608 increasing 20 basis points over the last seven days.

Even a quarter of a percent difference in your interest rate on a 300000 loan can add 40 to 50 a month onto your mortgage payment and cost you more than 15000 in interest over the life of your loan. Enter how much you want to borrow under Loan amount. If youre 10 years into a 30-year mortgage you can refinance the remaining amount to spread those 20 years of payments across 30 years lowering your monthly.

You can usually refinance a few years down the road to get rid of mortgage insurance and reduce your monthly mortgage payment. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax.

PMI will typically cost between 05 and 25 of your loan value annually. How Much Money Can I Afford to Borrow. Todays national mortgage rate trends.

Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. You can shorten your loan term You can refinance your 30-year mortgage to a 15 year loan to pay it off faster and for less interest overall. When you take out a mortgage you agree to pay the principal and interest over the life of.

The 503020 budgeting rule means separating your income into three portions. Homeowners and mortgage holders the total amount of tappable equity the amount available to borrow against while still keeping 20 rose by 12 trillion in the first quarter of. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage.

If you opt to use an escrow account or your lender requires it youll also have your property taxes mortgage insurance and homeowners. If interest rates have fallen since you first got your mortgage a rate-and-term refinance can replace your loan with a new one that has a lower rate meaning. The minimum down payment is 5 for the first 500000 10 for the portion of the house price above 500000 up to 1 million dollars and 20 for any house price over 1 million dollars.

Refinance the mortgage this includes a full valuation. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. Most mortgage loans require a.

How to borrow from home equity. This provides you a ballpark estimate of how much you can borrow from a lender. How much to put down.

Before you can obtain a mortgage you must undergo a qualification process. Your total interest on a 250000 mortgage. Inflation has been the highest in 40 years and.

Adjustable-rate Mortgage 10 to 40-year Mortgage VA and FHA Loans. How Much Can I Even Borrow. In the end when making the decision to acquire a property the borrower needs to consider various factors.

The loan is secured on the borrowers property through a process. If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example. Most future homeowners can afford.

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. Learn what factors determine how much people can typically borrow. As of June 2021 the average home loan for existing home buyers was over 500000.

So the value of the property can also limit how much you can borrow. Heres what typically makes up a mortgage payment. To qualify for a Rural Housing.

When to consider a refinance of your reverse mortgage.

Fbkrro80 Lcsmm

Heloc Calculator Calculate Available Home Equity Wowa Ca

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

40 Catchy Summer Home Loan Slogans List Phrases Taglines Names Aug 2022

Reverse Mortgage Guide The Truth About Reverse Mortgages

Personal Loan Contract Template Awesome 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Business Rules Personal Loans

Second Mortgage Lenders Qualifications Rates Wowa Ca

Credit Requirements For A Reverse Mortgage Loan

Do Home Loan Rates Change On Your Existing Loan Quora

What Are Current Mortgage Rates In The Uk Quora

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

Debt Archives Financial Samurai

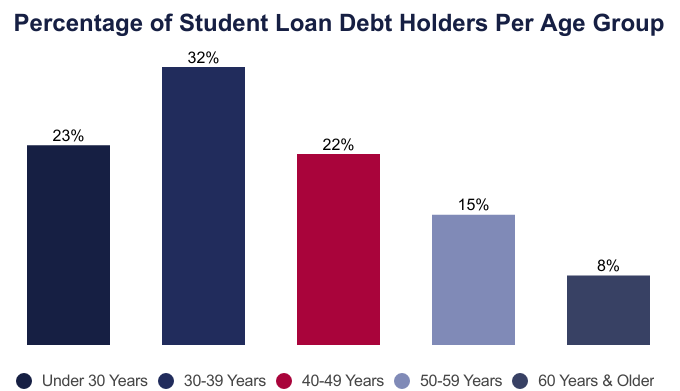

Average Student Loan Debt By Age 2022 Facts Statistics

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

40 Catchy Cash Loan Slogans List Phrases Taglines Names Aug 2022

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage